What is Order Flow:

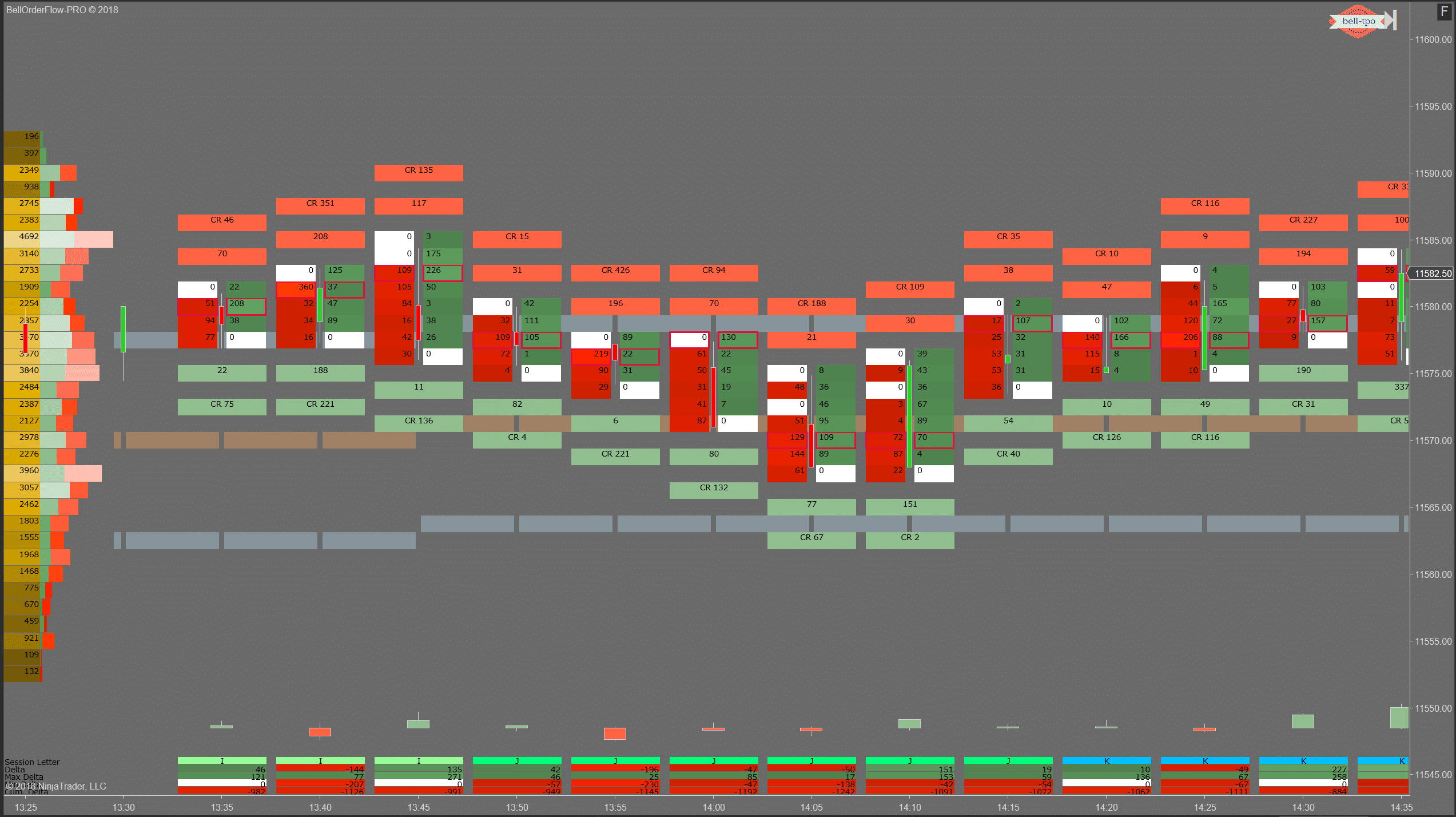

Prices of a commodity or a stock or any other product is driven by the law of Demand and Supply at a particular time. When the demand of a product or a stock increases, price of product / stock would increase. Similarly demand contracts, the price of the same would decrease. How would you determine the demand of a stock is increasing or decreasing in the stock market. Order Flow is a sophisticated tool for identifying the demand/ supply at a particular time. Order flow trading is probably one of the oldest methods of trading, which is about forecasting where big traders are placing their orders and generating trading decisions based on others’ positions. It is an estimation of the direction of market movement and how the trades of big brokerage houses/institutions are affecting the market.

Order flow trading requires identification of an ideal trade locations and cashing on the opportunity. It is generally done using the order books, which are essentially an electronic list of Buy and Sell orders, arranged as per price time priority. The size as well as the price of these orders is mentioned in the order book, which becomes a great tool to analyse the market direction. Order flow tells us when to trade. A trader can use an order flow sequence tracker to analyse the demand / supply at a particular time. This information flows to the trader intraday and is based on order flow sequencing. Similarly, block trades are indicative of large scale institutional involvement and high volume areas. Therefore, using order flow, a trader can determine the entry points in the trade.

for more information Visit : https://www.belltpo.com