Knowledge Hub

Basics of Market Profile Technical Analysis

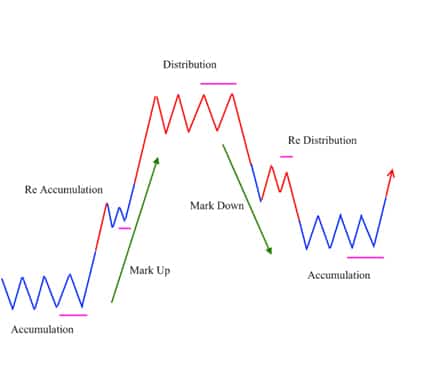

Market Cycle

It is the cycle in which the markets move up and down through various stages such as Accumulation – Mark Up – Distribution – Mark Down and sometimes the intervening stages of Re-accumulation and Re-distribution.

AMT

Auction Market Theory proposes that all financial markets work like an auction. That the price will move higher in search of sellers and price will move down in search of buyers.

Once the price has move low enough to uncover buying strong enough to stop the down auction, a new auction up will begin.

Market Profile Charts can be used effectively along with AMT principles to trade low risk opportunities in financial markets.

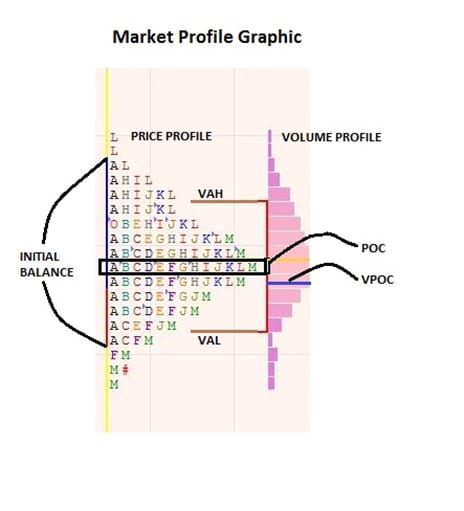

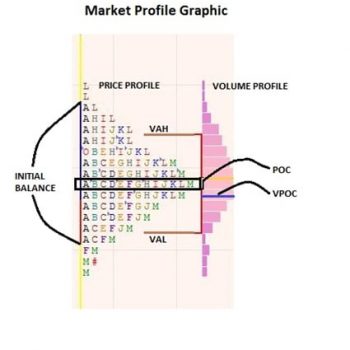

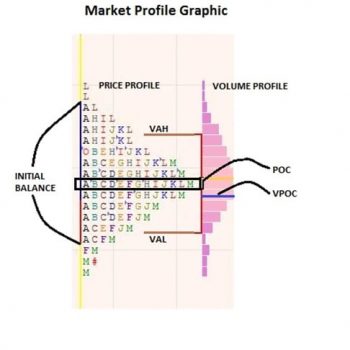

Market Profile

Market Profile is a way of organizing data. It organizes data in such a way that it reveals various AMT principles in real time.

In a MP chart the regular bars and candlesticks are replaced by letters (one letter for each 30 min bar is the most common setting). These letters are then collapsed on to the price axis to give it a distinct shape, which sometimes resembles a bell curve.

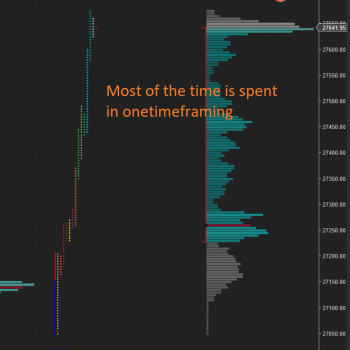

Normal

When price stays within the initial balance the whole day the day type is called as a Normal Day.

- Balanced Profile

- Wider Initial Balance

- maximum participation happens at the center of the profile

- Directional IB Breakout

- OTF Shows their presence

Normal Day

- Swift early entry of OTF

- Then OTF buyer/seller auction price within wide IB

- Caused by overnight or early News Announcements.

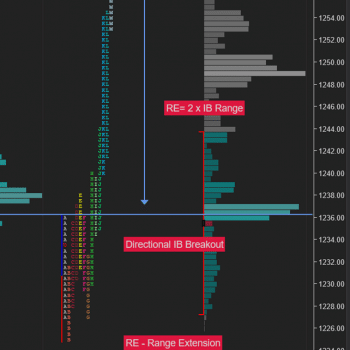

Normal Variation

When price moved outside of initial balance in subsequent periods, but does not create a range greater than twice the initial balance the day is called a Normal Variation Day.

- Typically an imbalanced profile

- The range extension is more than 2 times the Initial Balance

- Higher timeframe in control

- Initial Balance is typically smaller than the normal day

- but higher than the trend day.

Normal Variation Day

- Early activity not as dynamic as Normal day.

- Later OTF enters and extends the range substantially.

- Range extension points to presence of OTF participant.

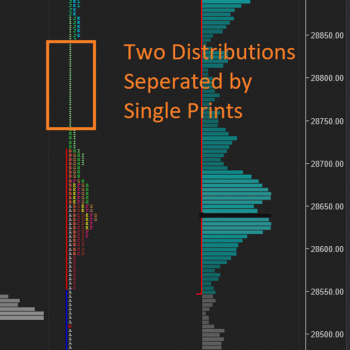

Double Distribution Trend Day

When price forms a narrow balance to begin with and then BO/BD from that balance and then form a second balance in the same day, the day type is called a double distribution trend day.

- Distribution is an imbalance profile where Initial Balance

- Two Balance Regions created separated by Single Prints

- Higher timeframe in Control

- Smaller IB range

- Those Single Prints indicates the presence of higher timeframes

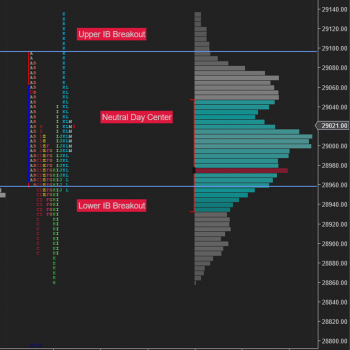

Neutral

When price extends range beyond the IB in both directions and closes within the value area, it is called a Neutral Day.

- Neutral Day is a balanced profile where initial range is smaller than Normal day.

- Both the Other timeframe buyers and other timeframe sellers are Present

- Range Extension happens on both the sides

- Price closes around the center of balance

Neutral Center Day

- OTF buyer and sellers have a close view of value.

- Both OTF buyer and seller are present, evidenced by range extensions on both sides.

- Price closes in center of the profile after trading at both extremes, indicates between OTF buyers and sellers.

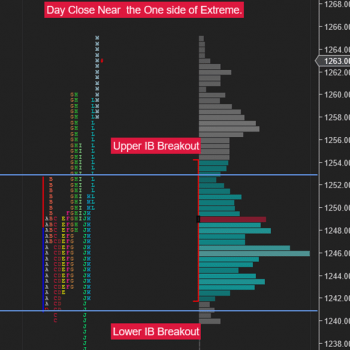

NEX

When price extends the range in one direction and then moves in opposite direction and extending the range at the other end, as well as closing on the extreme, is called a Neutral Extreme day.

- The days developments are similar to Neutral Center Day.

- Only the close is at one of the extremes.

- This indicates a hypothetical victory for on of the paricipants.

Profile Type – Neutral Day Extreme

- Neutral Day is a balanced profile where initial range is smaller than Normal day.

- Low volume in the first half. Lack of Higher timeframe in the first half.

- Second half will be exciting as volume starts flowing and price breaks both the IB low and IB high with strong volumes. Shows the dominance of higher timeframes stepping in.

- Price closes on one of the days extreme

Open Types

OIR

- When prices open inside yesterday’s range, we call it Open Inside Range.

- The range development potential is limited.

OOR

- When prices open outside yesterday’s range, we call it Open Outside Range.

- In this scenario the range development tends to be wide, and dynamic moves can be expected.

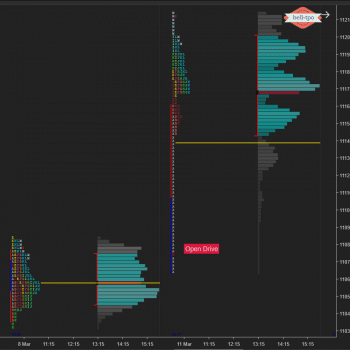

Market Opening Type : Open Drive (OD)

- Open Drive exhibit maximum confidence from the OTF timeframe traders

- Opens Gap up and Never got back into the previous day range

- Opens Gap up and Trades in the same direction of the previous day

- Low made in the first 30 min never taken out throughout the day

- Witnessed more in Bear market counter rally

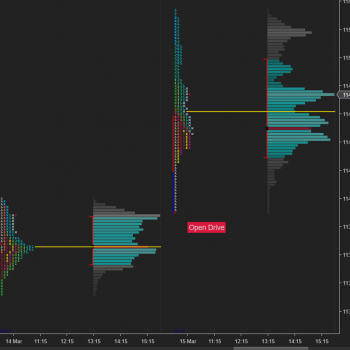

OTD

- Market opens and test beyond a known reference to check for any unfinished business, if not found we resume the drive.

- Second most confident opening.

OOD

- Market opens and drives confidently in one direction.

- Price seldom returns to the opening level.

Market Opening Type : Open Test Drive (OTD)

-

- Price Opens with Gap above/below Previous days range or Price Opens at the edge of the previous days range

- Confidence exhibited by OTF timeframe traders is less than that of Open Drive

- Opens Gap up and price got snaps back into the previous day range or value area in first 30min

and once test is over Trades in the same direction of the previous day

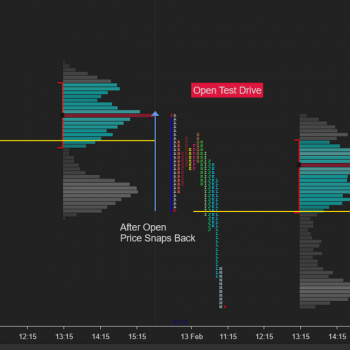

ORR

- Market opens and moves in one direction till it loses momentum and interest.

- Spotting this opposite party enters and moves the prices confidently in the direction opposite to open.

- But this early confidence is often short lived and range development is often not very wide.

Market Opening Type : Open Rejection Reverse

- Price Opens with Gap above/below Previous days value area

- Looks like a Open Drive but soon it faces resistance and later aggressive sellers enter into the market and drive lower

- Emotional traders get caught in this action

- Happens especially at the end of the bear market/bull market

- Market Participants are less confident of such opening

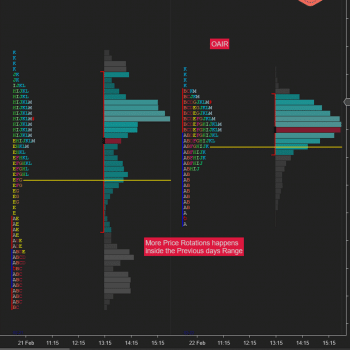

OAIR

- Market opens inside previous day’s range and auctions in a narrow range.

- Weakest open.

Market Opening Type : Open Auction in Range (OAIR)

- Price Opens within Value Area

- Trades lackluster, Sideways

- No Confidence from the OTF Participants happens in sideways balancing markets with overlapping Value area

- Open Auction nothing changed from previous day context

OAOR

- Market opens outside previous day’s range and auctions in a narrow range.

- Even though the initial range is limited there is always a chance of a dynamic move later in the day.

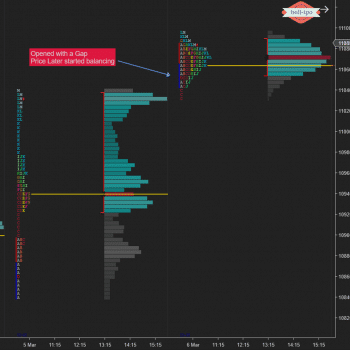

Market Opening Type : Open Auction Outside Range (OAOR)

- Market Open Outside Previous days range

- Value forms higher or lower with balanced profile

- Price starts balancing around the centre

- Mostly a lackluster day around the open

- Despite a gap up/gap down

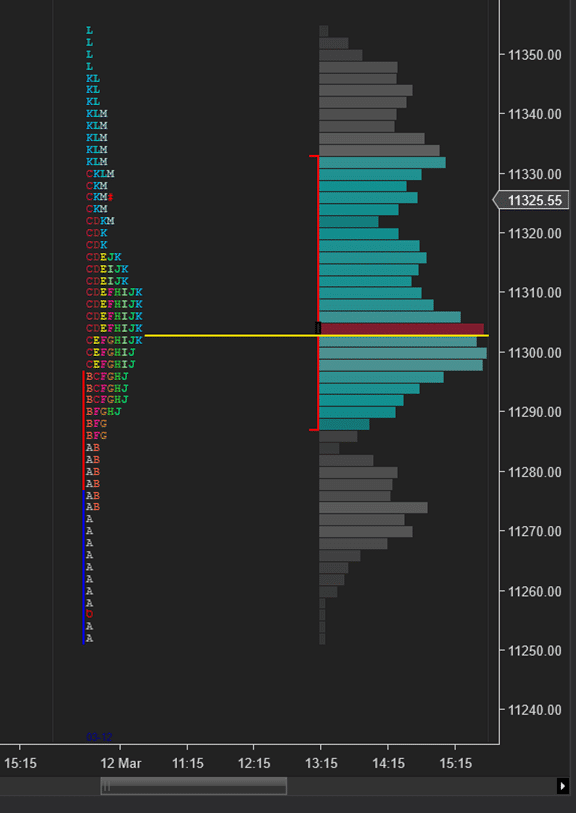

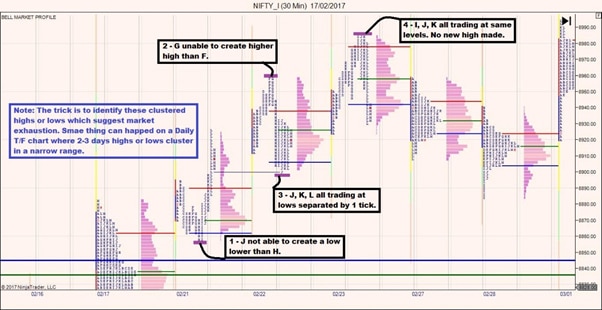

Structural details

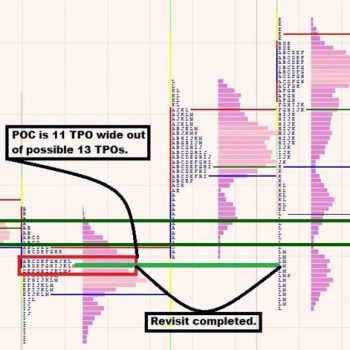

Initial Balance

- The range of the first 2 bars or first 2, 30 min periods form the initial balance.

Tails

- When price probes a reference and get rejected in the same time period we get a tail.

- Tails show end of one auction and start of another.

- Sometimes tails are also classified as excess.

Spikes

- When price moves away from established value especially near the close the development is called a spike.

- Spikes can be because of old business or new business.

- In later case we get continuation and former case we get retracement.

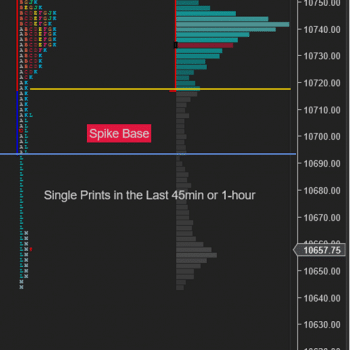

Profile Type – Spikes

- Price spikes in the last 45min or 1hour of trading activity

- Late Reactions from the Market Participants especially the higher timeframe (OTF)

- If it happens at the swing extreme could be a sign of Short-term inventory getting long to too long or inventory getting short to too short.

Old Business

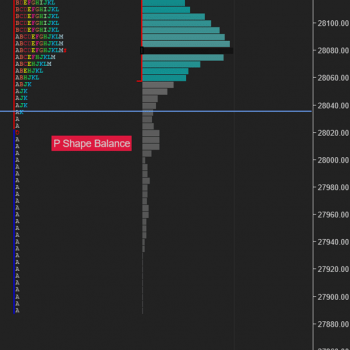

- When a dynamic move up/down subsequently takes a ‘P’ or ‘b’ shape respectively, we call if old business.

- ‘P’ shape denotes short covering.

- ‘b’ shape denotes long liquidation.

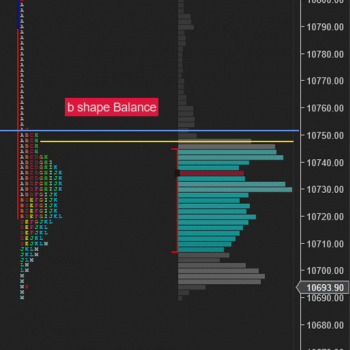

Profile Type – b Shape Profile

- b Profile days are long liquidation days and the letter A or B forms the top with single prints in the Initial Range and market opens at the top of the profile.

- The price rotation happens at the bottom of the profile (i.e at the range extension area).

- Indicates long liquidation (old money exiting longs)

Anomaly

- Sometimes the profile is not smooth and has ragged edges to it.

- These ragged edges are called anomalies.

- Anomalies denote forcing action.

- Forcing Action

- It means that every time the opposing activity increases the traders with the original trend over power them.

- This leads to anomalies and multiple distributions in a profile.

- Forcing action is liable to retracement.